ending work in process inventory calculation

Ending Work In Process Double Entry Bookkeeping At that point the inventory is no longer raw. Here are the steps for using the gross profit method of calculating ending inventory.

Inventory Formula And Calculator

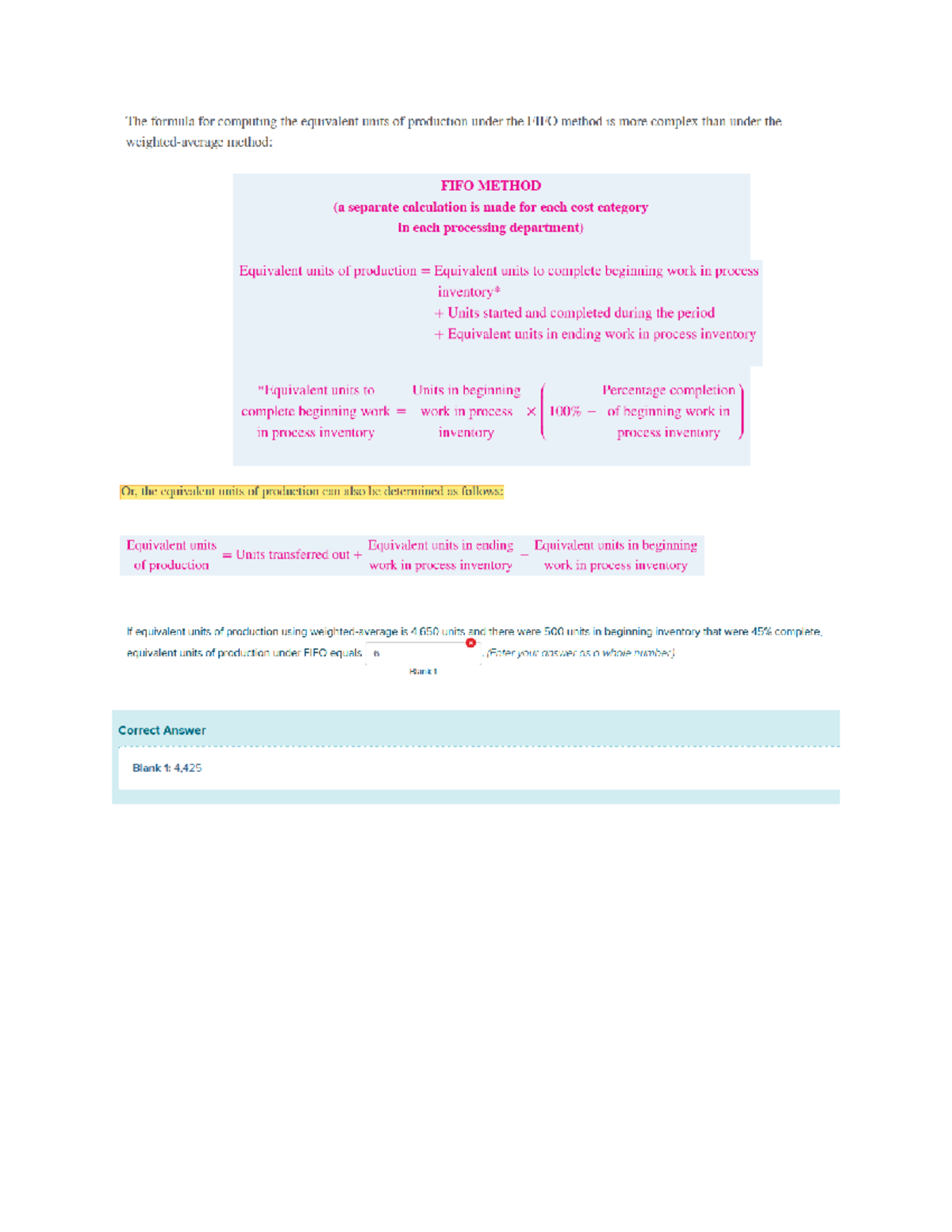

Under FIFO Inventory Method the first item purchased is the first item sold.

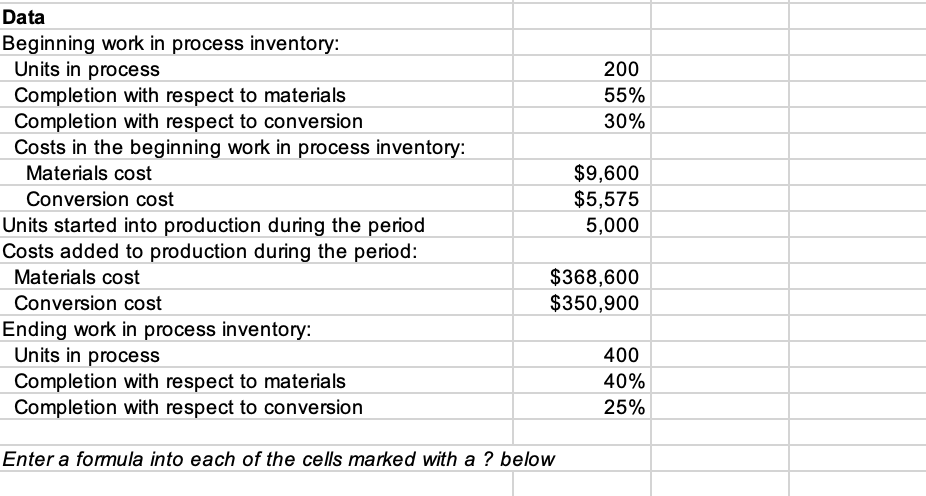

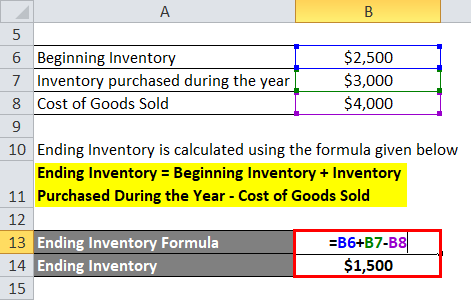

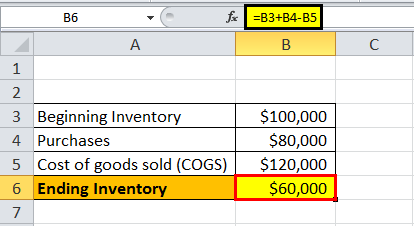

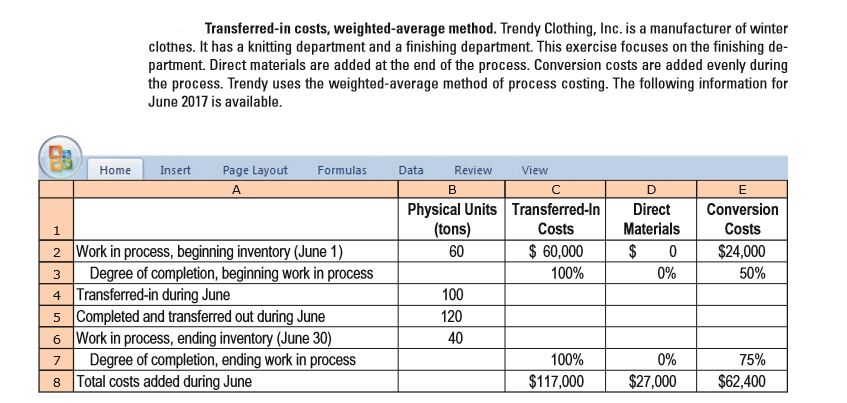

. How do you calculate work in process. Answer of Calculate the ending Work in Process Inventory balance on June 30. Ending Inventory beginning inventory net purchases - prices of products sold Ending Inventory 30000 35000 - 45000 Add together the beginning inventory and net.

How do you calculate ending work in process inventory. With Work-in-Process software materials are tracked online in real time allowing immediate visibility into a work order and immediate responsiveness if action is needed. Generally WIP also known as in- process inventory can.

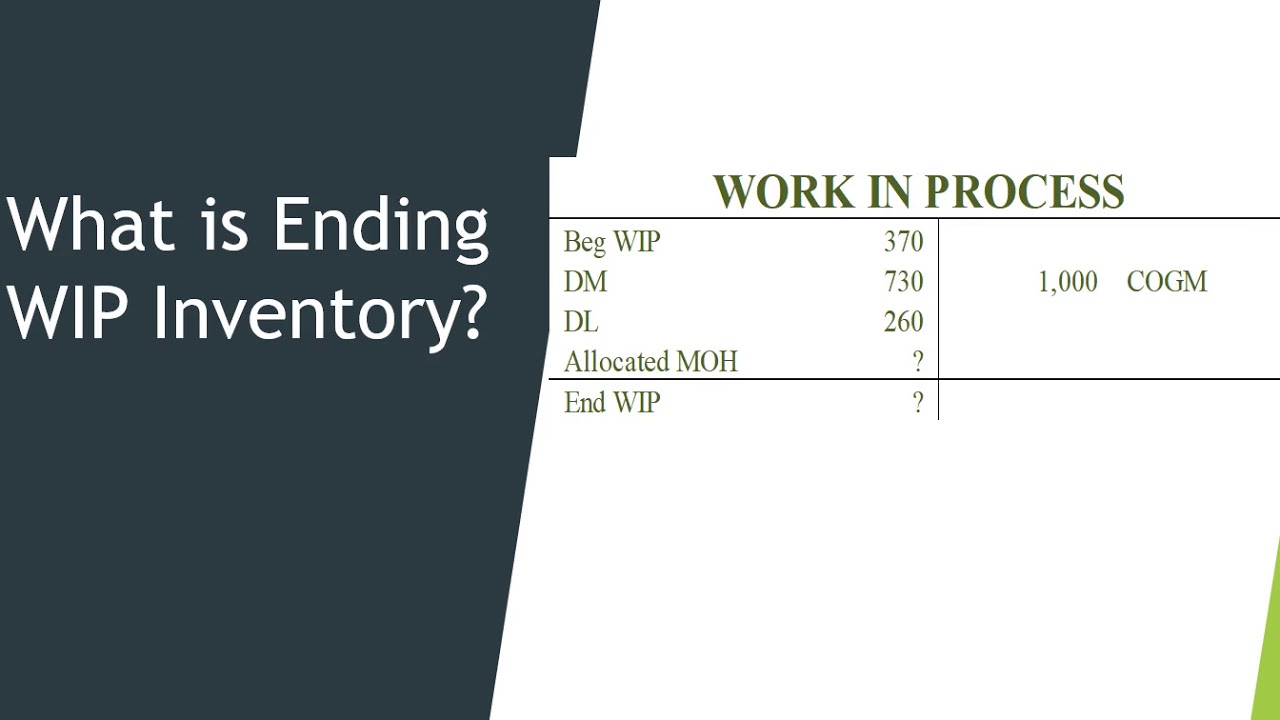

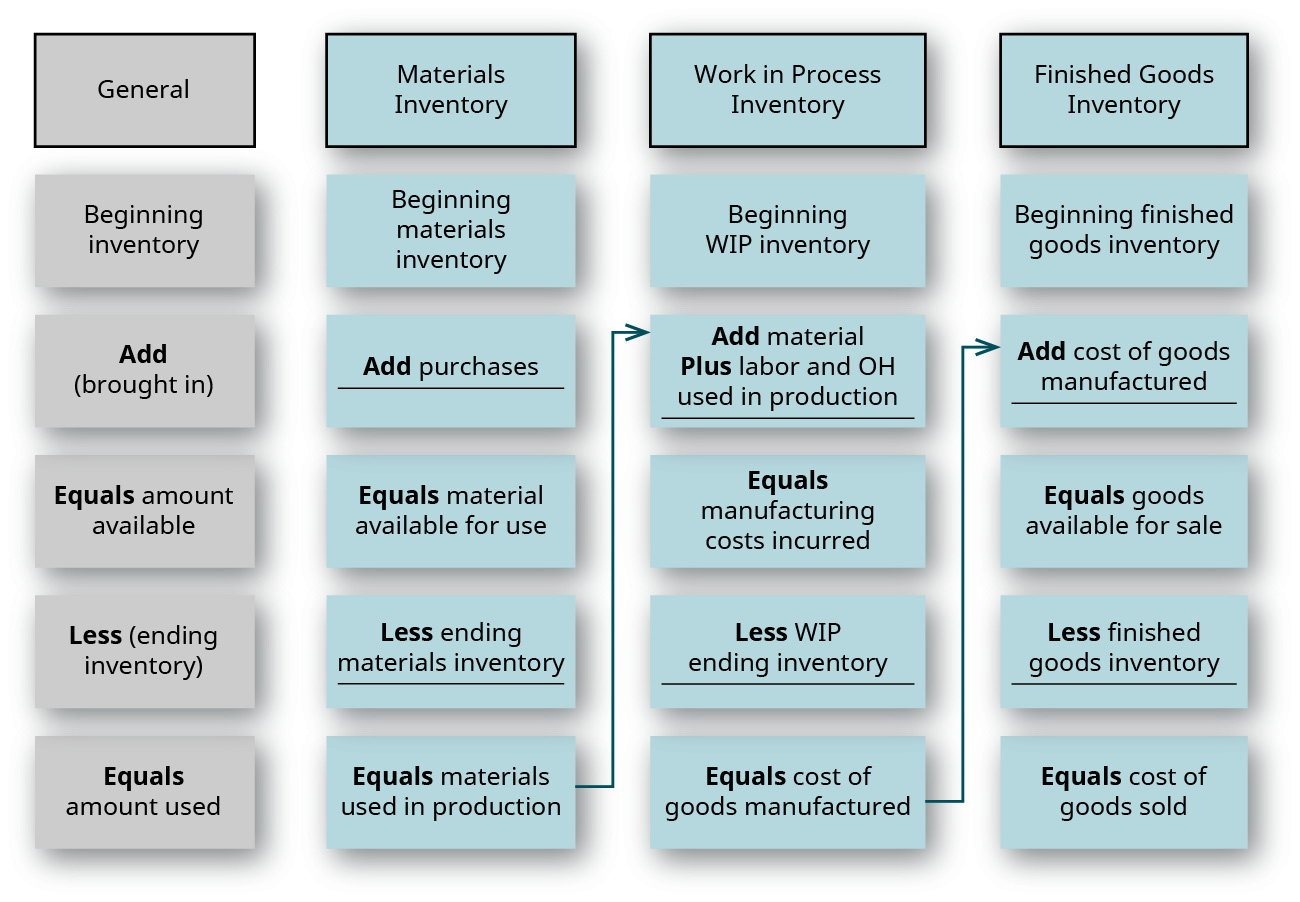

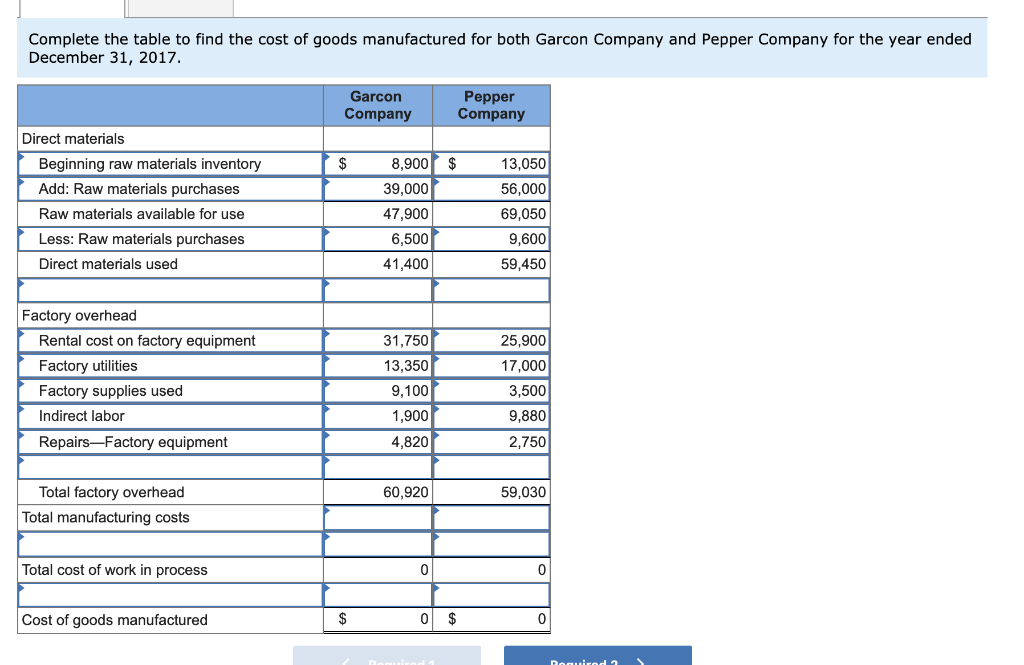

It will consist of finished semi-finished and. You can do this by adding the cost of your. WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS.

WIP is calculated after. What is the formula to calculate ending inventory. Find the cost of goods available.

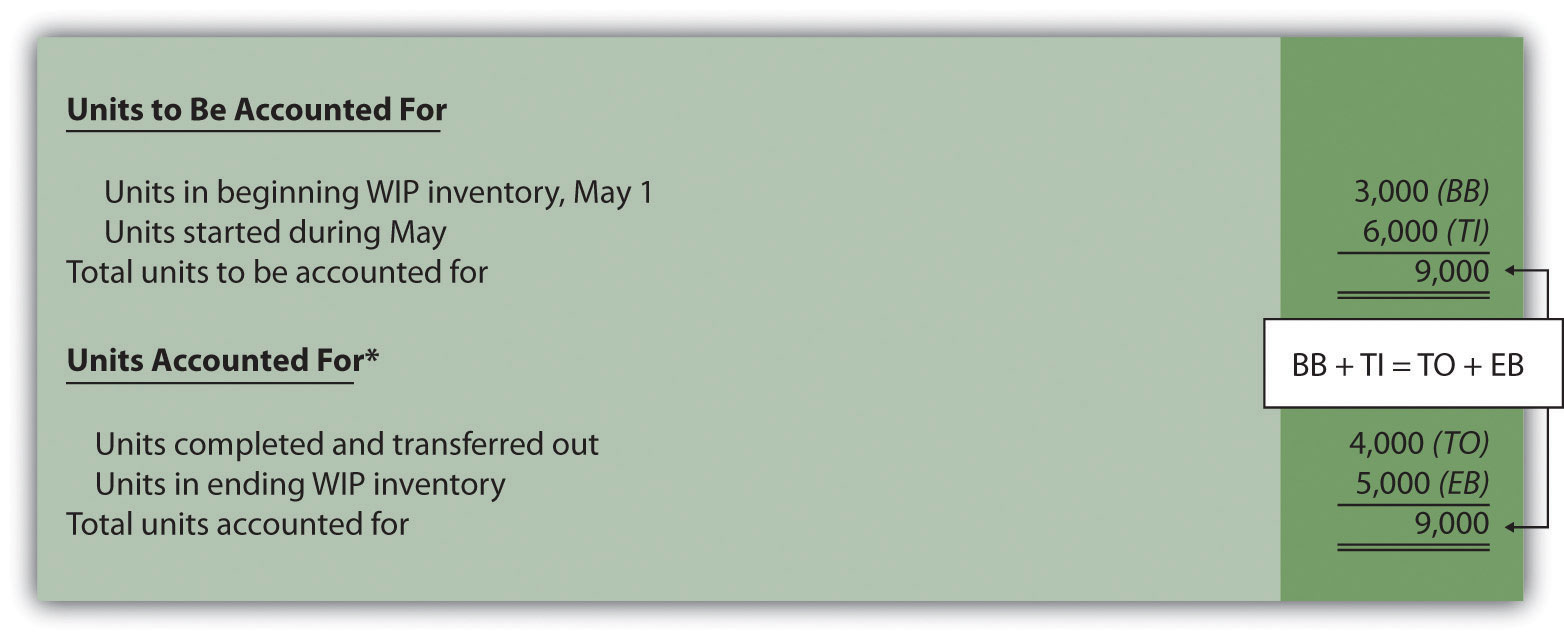

Here is the basic formula you can use to calculate a companys ending inventory. Each accounting cycle starts with an amount for the beginning work in process. Formulas to Calculate Work in Process.

3 Methods to Calculate the Ending Inventory 1 FIFO First in First Out Method. How do you calculate ending inventory units. Beginning inventory net purchases -.

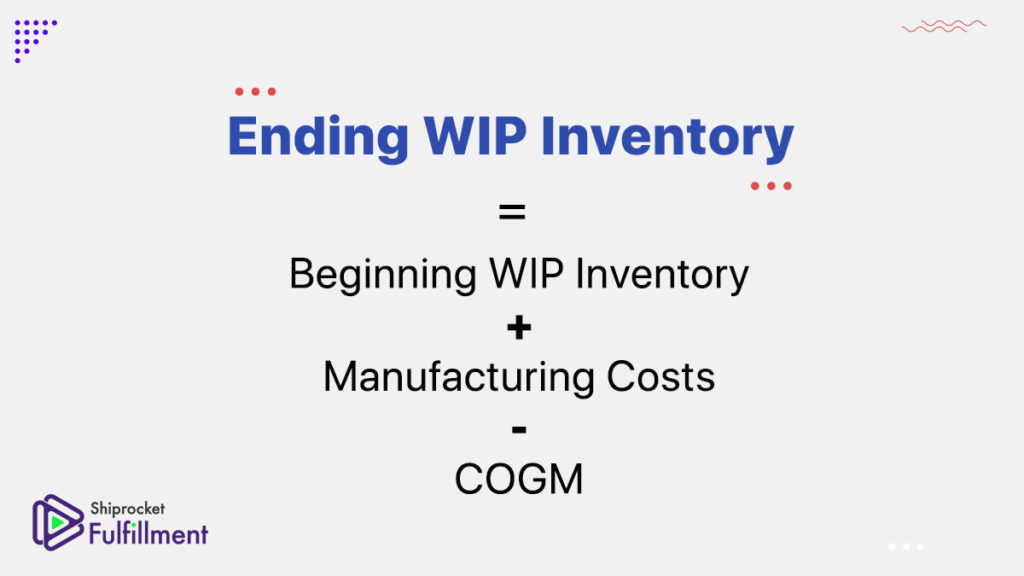

Generally WIP also known as in-process inventory can be described as the goods that are still in the production process yet to be completed for final sale. For example if your business is calculating WIP inventory at the end of each quarter and your accounting records show that your ending WIP inventory. How to Calculate Ending Work in Process Formula Beginning Work in Process.

Multiply 1 expected gross profit by sales during the period to arrive at the estimated cost of goods sold. 2 LIFO Last in First Out. Wikipedia describes work in process inventory as a companys partially finished goods awaiting completion and sale.

First determine the inventory of the company at the beginning of the year from the stock book and confirm with the accounts department. Most businesses calculate their work in process inventory at the end of the accounting period such as a quarter or year. In this scenario your ending work in process inventory would be.

Beginning WIP Inventory Manufacturing Costs COGM Ending WIP Inventory. Calculate the cost of average inventory by adding together the beginning. Beginning WIP DM DL MOH Cost of goods manufactured Ending WIP.

WIP Inventory Example.

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

8 4 Tracing The Flow Of Costs In Job Order Financial And Managerial Accounting

Work In Progress Wip What Is It

Solved 1 What Is The Inventory Formula That Shows The Physical Flow Of Course Hero

Ending Inventory Formula Calculator Excel Template

Work In Process Wip Inventory Concept And Formula Explained Shiprocket Fulfillment

Ending Inventory Formula Step By Step Calculation Examples

Chapter 17 Process Costing Ppt Download

Ending Inventory Formula Step By Step Calculation Examples

Ch 5 Homework Old Country Links Inc Produces Sausages In Three Production Departments Mixing Studocu

Solved The Following Information Pertains To Expert Systemcorporation Beginning Workinprocess Inventory 18 000 Ending Workinprocess Inventory 25 Course Hero

Answered The Following Data Is Provided For Bartleby

How To Calculate The Ending Work In Process Inventory

Answered Transferred In Costs Weighted Average Bartleby

Accounting Treatment Of Work In Progress Explanation Examples Finance Strategists

Inventory Formula Inventory Calculator Excel Template

Solved Beginning Finished Goods Inventory Beginning Work In Chegg Com